April 27th, 2020.

How Is Coronavirus Affecting the Self-Employed Property Industry?

The current pandemic has touched everyone’s lives in some way. But, with many investors, developers, and tradesmen in the property sector being self-employed, the financial uncertainties have been much greater for most.

UK Self-Employment at The End of 2019

According to the Office for National Statistics’ ‘Coronavirus and Self-Employment in the UK’ report, by the fourth quarter of 2019, there were more than 5 million self-employed people in the UK, representing 15.3% of employment.

The vast majority work for themselves (over two thirds), with running a business (20%) and being a sole director of their own limited business (15%) being the next most common.

In 2019, two-thirds of the UK’s self-employed population were men (3.3 million), and the industries they worked in were different to women. Over a quarter of self-employed men were involved in the construction industry. The top five most common groups for men were:

- Construction and building trades – 481,000 people

- Road transport drivers – 292,000 people

- Agricultural and related trades – 197,000 people

- Artistic, literary and media occupations – 171,000 people

- Managers and proprietors in other services – 160,000 people

For women, the most common occupation groups were artistic, literary and media occupations, closely followed by hairdressers and related services.

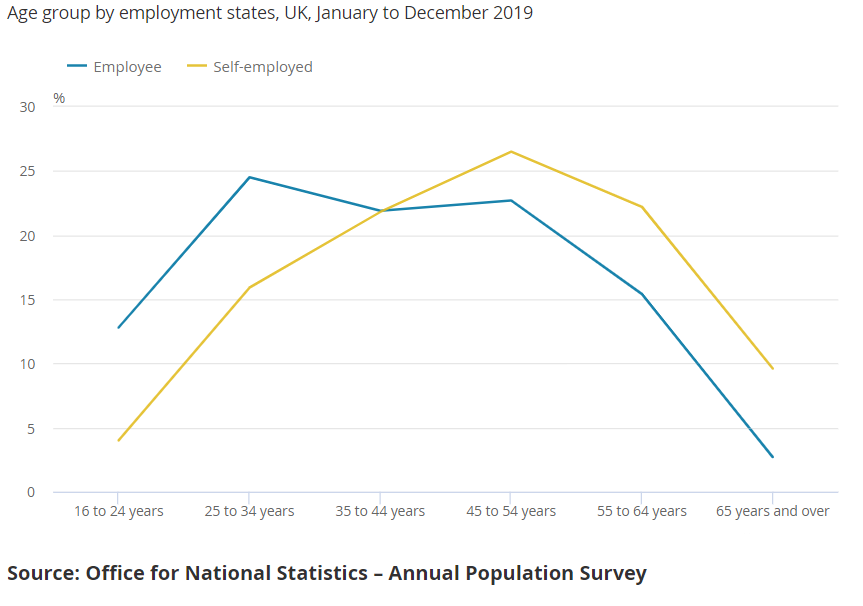

Data has also revealed that self-employed people tend to be older than the average employee, with the most common age range being between 45 and 54 years old. ONS suggests this may be because older people are more financially resilient and can take more risks than their younger counterparts.

So, what does all this mean? Well, in short, older men in the construction industry will be amongst the hardest financially hit amongst all individuals during this pandemic.

How Is Coronavirus Disturbing the Property Industry?

For many, construction has stopped, stockists have shut, and property sales have faltered due to the enforced government lockdown. There are outliers – for example, some digital property viewings – nevertheless COVID-19 has affected the property industry at all stages, from development through to completion.

Coronavirus and Property Development

With contagion a high priority and supply chain interruptions leading to a shortage of materials, the vast majority of sites are now closed until further notice – including private developments, as well as those run by housing associations or local authorities – and although this puts safety at the forefront, there will be an inevitable impact on the already vast housing shortage we have in the UK.

Government guidance is that construction sites can remain open with correct site operating procedures which align with public health guidance, but most have weighed out the risk and difficulties to social distance on a building site and decided to pause operations.

Savills has reported that, at the end of March, construction had been halted on sites with the capacity to build 193,000 in England, 18,900 in Scotland, and 8,500 in Wales – an equivalent to 79% of the total supply. Consequently, there will be drastic drops in the number that come to the market this year.

Real estate group CBRE warned the Financial Times that private development in London could fall by more than 50% if building sites are kept closed until July, resulting in a drop in output from the 22,000 five year average to just 10,000 delivered in 2020.

So, what do these development site closures mean for the individuals involved? For those self-employed people at the top, this will delay progress and return on investment, possibly leading to cash flow issues.

Land acquisition deals and planning applications that began before lockdown are mostly still going ahead, but there are delays expected for completions and approvals.

For self-employed labourers and skilled workers, there will be a lack of jobs and no chance of furlough, meaning the availability of other government grants and help schemes will likely need to be assessed.

Read more: Could Redistributing the Houses of Parliament Refurb Budget Solve the Housing Crisis?

Coronavirus and the Property Market

Global consultancy Knight Frank has predicted the property market will go into deep freeze, with little movement, but values will only fall by 3% and rebound next year by 5% due to an assumption the economy will shrink 4% this year and grow 4% next. Its forecasts suggest house sales in the UK would drop from 1,175,000 last year to just 734,000 in 2020.

Viewings, and therefore sales, have become almost non-existent, meaning many are holding off from putting their properties on the market or removing them from sale. This has led to many estate agents being furloughed as a result.

In mid-April, Rightmove revealed it had already seen a 40% fall in listings since 26th March, and just 65,531 new listings between March 8th and April 11th – almost half the 112,570 listed between March 10th and April 6th, 2019. As a consequence, estate agency Foxtons has furloughed more than 750 employees.

Liam Bailey, the Global Head of Research at Knight Frank, told The Guardian:

“The housing market was in a strong position in January and February. A sharp uptick in sales and price growth was seen across the UK, with even the prime central London market seeing a reversal of a five-year-long price decline.

“We [now] have to expect weaker economic activity in the first half of 2020, the dislocation in the jobs market and weakened consumer sentiment will impact on prices – however, the relatively finite timespan of the crisis means declines will be limited.”

350,000 fewer mortgage approvals in England and Wales are expected, including 150,000 for first-time buyers. Knight Frank continues to state homeowners will spend £7.9 billion less on DIY and renovations, removals companies will lose £395 million, whereas the exchequer will miss £4.4 billion in stamp duty.

On the flip-side, Zoopla has reported demand for homes to rent has grown by 30% in the two weeks leading up to April 21st, and the effect of Coronavirus has been less extreme than for the sales market due to rent’s flexibility. For many with immediate housing needs, renting provides a temporary solution whilst the effects of the pandemic on the housing market are uncertain.

In particular, short-term leases are growing increasingly popular as key workers seek temporary accommodation away from family and roommates because of safety worries.

Coronavirus and Commercial Finance

It’s no secret that since lockdown began, borrowing has become a mixed bag. Some lenders are continuing business as usual, remaining open in the belief that it will all blow over soon, some are open but reviewing their status weekly, whereas others have paused new lending completely.

Of course, there are some logistical issues, mostly around valuers and project monitors not being able to safely visit sites, but deals are continuing where possible with time being spent on due diligence before ground can be broken.

So, what does this mean for self-employed people in the property industry, and the outlook for the end of 2020?

Well, we’d expect to see a rise in the number of people switching to full-time employment to safeguard their incomes against any future pandemics. However, with a return to business as usual and a restrengthening of the industry, we believe most will stay true to their self-employed status, praying a similar event does not reoccur.

In the short term, the majority will be able to apply for support from the government – read more about this in our post: How is the Government Helping Businesses Affected by Coronavirus?

However, the aforementioned ONS report reveals that 3% of all self-employed people in the UK have been continuously self-employed since April 2019, meaning that they may not be eligible for the government’s Self-Employment Income Support Scheme.

This, alongside delays in recouping investment costs due to development pauses, could mean a number of individuals will soon be seeking alternative forms of finance.

If you have a current loan in place and are predicting payment difficulties, we would recommend reaching out to your lender and making a business case for a deadline extension, postponement of milestones, or to secure a contingency. This will be assessed on a case-by-case basis and will not be possible for all.

As a result, here at Pure Commercial Finance, we’re predicting a rise in bridging finance and development exit loans as people seek to extend their original funding deadlines.

And, we’re here to help. Many of our staff are working from home during lockdown, meaning they’re on hand to help find you the funding you need. Get in touch today to discuss your financial situation.